pinup-bets.site Overview

Overview

Polkadot Nodes

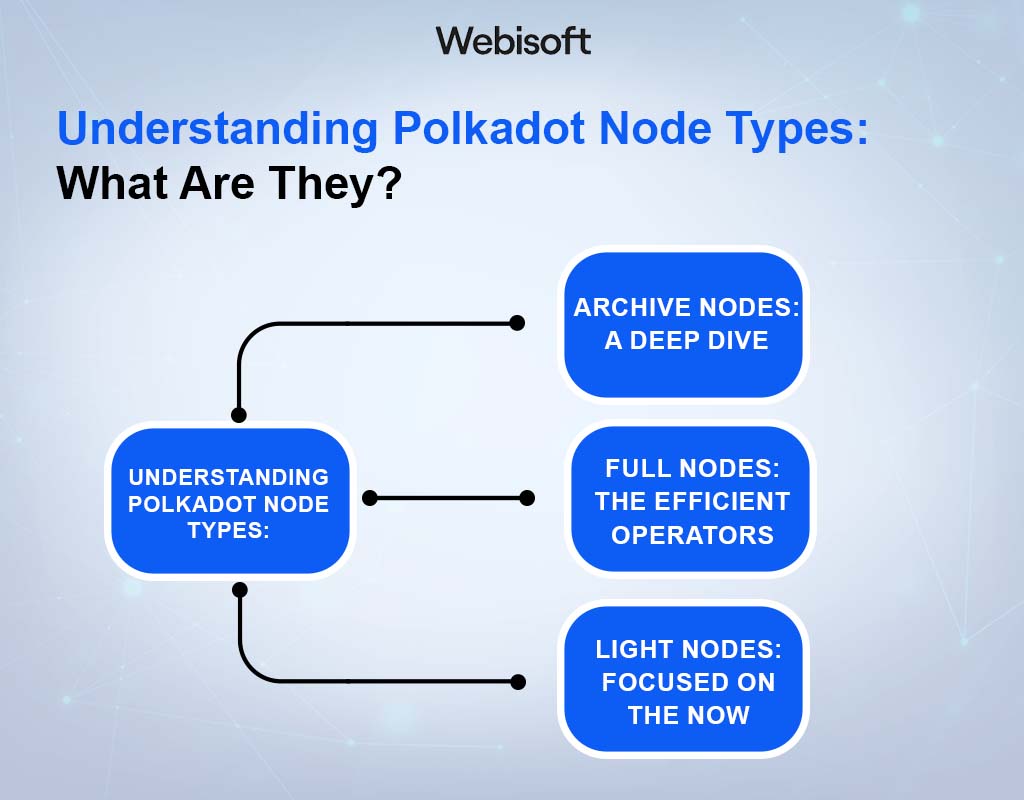

A node is a peer in the peer-to-peer network. Nodes communicate with each other to reach consensus on the state of the network. Within Polkadot there are. Kusama is a network built as a risk-taking, fast-moving 'canary in the coal mine' for its cousin Polkadot. It's a living platform built for change agents to. This guide aims to provide a Polkadot node setup and running for Windows, Linux and Ubuntu. Follow a step-by-step guide to set up and run a full node on. In addition, Polkadot has developed a thriving sibling chain with an almost identical codebase — Kusama (KSM). Kusama acts as a looser testing environment for. Polkadot is a decentralized network that can connect various blockchain networks and enable them to seamlessly cooperate. The network is managed by a. Learn how to stake DOT on Polkadot's secure, decentralized network. Discover the benefits of native staking, compare options, and start earning rewards. active validators and waiting (that is, they are running a validator node but have not been elected into the active set this era). Polkadot is a heterogeneous network designed for Web3 infrastructure consisting of multi-chain public, private and independent blockchains interconnecting. Zeeve is the preferred partner for Polkadot developer and validator nodes. Use Zeeve managed service to deploy and manage Polkadot nodes. A node is a peer in the peer-to-peer network. Nodes communicate with each other to reach consensus on the state of the network. Within Polkadot there are. Kusama is a network built as a risk-taking, fast-moving 'canary in the coal mine' for its cousin Polkadot. It's a living platform built for change agents to. This guide aims to provide a Polkadot node setup and running for Windows, Linux and Ubuntu. Follow a step-by-step guide to set up and run a full node on. In addition, Polkadot has developed a thriving sibling chain with an almost identical codebase — Kusama (KSM). Kusama acts as a looser testing environment for. Polkadot is a decentralized network that can connect various blockchain networks and enable them to seamlessly cooperate. The network is managed by a. Learn how to stake DOT on Polkadot's secure, decentralized network. Discover the benefits of native staking, compare options, and start earning rewards. active validators and waiting (that is, they are running a validator node but have not been elected into the active set this era). Polkadot is a heterogeneous network designed for Web3 infrastructure consisting of multi-chain public, private and independent blockchains interconnecting. Zeeve is the preferred partner for Polkadot developer and validator nodes. Use Zeeve managed service to deploy and manage Polkadot nodes.

List of 6 RPC Node Providers on Polkadot · Aptos · Arbitrum · Avalanche · Bitcoin · BNB Chain · Celo · Cosmos · Cronos. Polkadot is a next-generation blockchain network and, more generally, an ecosystem providing blockspace for all kinds of Web3 projects. Subscan | Substrate ecological explorer: Search, analyze, and visualize blockchain that occurs on Substrate based network (Polkadot, Kusama, Moonbeam. LeewayHertz's Polkadot blockchain node launch service offers more than just node launch. It provides a seamless and stress-free experience with expertly. Polkadot nodes connect to peers by establishing a TCP connection. Once established, the node initiates a handshake with the remote peers on the encryption layer. We have invested in backup nodes decentralised across multiple countries to minimise the possibility of disruption. Our computing infrastructure enables us to. The Polkadot ecosystem is made up of three different types of nodes, along with a node-nominator mechanism to help the Relay Chain maintain network consensus. NOWNodes is a great opportunity to join DOT blockchain or to lighten you crypto infrastructure. Connect to full DOT node, block explorer and testnet now! Polkadot API documentation: pinup-bets.site How to get network using @polkadot/api. . You have successfully bonded your coins. The Polkadot network includes a main blockchain called the “relay chain” and many user-created parallel chains (or “parachains”). It also has a connecting layer. nodes (nodes that store everything), validators that participate in Polkadots consensus and light clients that only verify claims about the state of the network. Polkadot ecosystem: compare these top 34 Polkadot RPC, nodes and data API providers or choose from 24 free public Polkadot RPC endpoints (updated on August. We'll use Docker and Polkadot's latest Docker pre-built image () to spin up and sync a node in under 5 minutes. Polkachu provides Substrate chain snapshots for node operators to quickly sync up a node. Connect in seconds to Polkadot via OnFinality's elastic API with a high availability of % uptime per year. Deploy full, validator, and archive Polkadot. Polkadot: Unifying Diverse Blockchains Seamlessly. Polkadot is a multi-chain blockchain platform that fosters interoperability between different blockchains. These self-sovereign blockchains are referred to as parachains. The Relay Chain acts as the central backbone of the Polkadot network. Parachains create blocks. Polkadot is itself a Substrate-based chain, composed of the exact same two components. It has specialized logic in both the node and the runtime side, but it is. Requirements for Light Clients · Secure bootstrapping and Synchronizing: The probability that an adversarial full node convinces a light client of a forged. The Polkadot Network rolls on with its impressive rate of seamless upgrades and improvements without breakage or downtime, a first in this.

Liberty Mutual Vs Geico

or speak to an agent for Assurant or American Modern Insurance Group®. Liberty Mutual. Liberty Mutual Fire Insurance Company; Liberty Mutual Insurance Company. Plus, coverage like this costs less than you may think Over $ lower than GEICO How do I contact Liberty Mutual about a customer service issue or to. Drivers with outstanding credit — a score of or better — should consider GEICO, which typically beats Liberty Mutual by $ per year. Liberty Mutual offers below-average rates. Our research shows that Liberty Mutual's average annual auto insurance policy costs $1, per year for full coverage. *For Named insured, Coverage, or Property address changes, the customer must contact Liberty Mutual by phone at the number listed on their declarations page or. State Farm beats Liberty Mutual when it comes to customer reviews and ratings, and the two companies offer a comparable selection of insurance options. The. GEICO is ranked higher than Liberty Mutual when it comes to the cheapest car insurance for an average driver, good customer satisfaction and fewest complaints. Liberty Mutual Insurance has more total submitted salaries than GEICO. Supervisor. Salaries. $75, GEICO has cheaper rates, with an average liability rate of $56 per month. Drivers with Liberty Mutual pay an average of $ per month. GEICO and. or speak to an agent for Assurant or American Modern Insurance Group®. Liberty Mutual. Liberty Mutual Fire Insurance Company; Liberty Mutual Insurance Company. Plus, coverage like this costs less than you may think Over $ lower than GEICO How do I contact Liberty Mutual about a customer service issue or to. Drivers with outstanding credit — a score of or better — should consider GEICO, which typically beats Liberty Mutual by $ per year. Liberty Mutual offers below-average rates. Our research shows that Liberty Mutual's average annual auto insurance policy costs $1, per year for full coverage. *For Named insured, Coverage, or Property address changes, the customer must contact Liberty Mutual by phone at the number listed on their declarations page or. State Farm beats Liberty Mutual when it comes to customer reviews and ratings, and the two companies offer a comparable selection of insurance options. The. GEICO is ranked higher than Liberty Mutual when it comes to the cheapest car insurance for an average driver, good customer satisfaction and fewest complaints. Liberty Mutual Insurance has more total submitted salaries than GEICO. Supervisor. Salaries. $75, GEICO has cheaper rates, with an average liability rate of $56 per month. Drivers with Liberty Mutual pay an average of $ per month. GEICO and.

Renters insurance quotes · Personal Liability and Medical Payments to others. This coverage helps pay for damages and/or injuries to others. · Personal Property. Do Not Sell or Share My Personal Information (CA Residents Only). © Liberty Mutual Insurance Company, Berkeley Street, Boston, MA | an Equal. Liberty Mutual. To get a free quote or learn more, visit Liberty Mutual savings for UW employees. To learn more about the PEBB program for group discounts. You could save $ on car insurance* · Switch to Liberty Mutual Insurance made available through the TruStage™ Auto & Home Insurance Program · Special savings. Geico is better than Liberty Mutual overall. Geico is cheaper than Liberty Mutual, on average, charging $66 per month for minimum coverage car insurance in. or through TruStage, Liberty Mutual or their affiliates, subsidiaries, and insurance company partners. Navy Federal Credit Union enables this insurance. Do Not Sell or Share My Personal Information (CA Residents Only). Give us your feedback. © Liberty Mutual Insurance, Berkeley Street, Boston, MA. GEICO is a part of the Berkshire Hathaway conglomerate and Liberty Mutual is a separate mutually owned insurance company. Mutual companies like. Compare company reviews, salaries and ratings to find out if Liberty Mutual Insurance or GEICO is right for you. Liberty Mutual Insurance is most highly. GEICO rates % lower than Liberty Mutual Insurance on Leadership Culture Ratings vs Liberty Mutual Insurance Ratings based on looking at ratings from. Get a comparison of working at GEICO vs Liberty Mutual Insurance. Compare ratings, reviews, salaries and work-life balance to make the right decision for. GEICO is known for its inexpensive insurance rates. According to The Zebra, the average monthly premium cost with GEICO is less than $ Liberty Mutual. For example, Liberty Mutual offers discounts for homeowners who have completed certain renovations or repairs, while State Farm has discounts for upgrading. Liberty Mutual does not currently offer wildfire mitigation actions insureds can take that would impact underwriting or rates in Oregon. Peerless Indemnity. Geico is tied with Nationwide for No. 4 in our rating of the best car insurance companies. It has an average annual rate well below the national average. Liberty Mutual offers more discounts, but Geico averages cheaper auto insurance rates. Both companies have high financial and customer satisfaction ratings. LIBERTY MUTUAL FIRE INS CO. SUITE , MARLTON. EXECUTIVE PARK. ROUTE 73 GEICO SECURE INSURANCE COMPANY. ONE GEICO PLAZA. WASHINGTON. DC. PRIV. Manage your American Modern Insurance Group® policy online or speak to an agent for Assurant or American Modern Insurance Group®. Liberty Mutual, Mountain. The best insurance company for you to go with is GEICO. They have cheaper rates when compared to Liberty Mutual for people who have scores below Ways to pay your bill. Choose from one of several easy ways to pay. Credit card or bank account. Log in and pay online using a major credit.

Best Bank To Go To For A Mortgage

View rates, learn about mortgage types and use mortgage calculators to help find the loan right for you. Prequalify or apply for your mortgage in minutes. An Equitable Bank reverse mortgage loan helps older Canadians tap into their mortgage from the comfort of your home or on the go. Get started today. NBKC: Best for FHA and VA loans · Rocket Mortgage, LLC: Best for refinancing · Guaranteed Rate: Best for first-time home buyers, jumbo loans and HELOCs · Alliant. AIB; Avant Money; Bank of Ireland; EBS; Finance Ireland; Haven; ICS Mortgages; MoCo; PTSB. How to choose the best mortgage lender. best with your budget. It also brings your banking together with a high-interest chequing account to go along with your mortgage. You'll enjoy free banking. At First Commonwealth Bank, we put you first with personal banking, small business solutions, mortgages, insurance, wealth management and more. Best for lower credit scores: Rocket Mortgage · Best for flexible down payment options: Chase Bank · Best for no lender fees: Ally Bank · Best for flexible loan. PNC is one of the best mortgage lenders, thanks in large part to their combination of a sophisticated website blended with mortgage loan officers operating. What Are the Best Mortgage Lenders? · New American Funding · Rocket Mortgage · NBKC Bank · Farmers Bank of Kansas City · AmeriSave · First Federal Bank · Veterans. View rates, learn about mortgage types and use mortgage calculators to help find the loan right for you. Prequalify or apply for your mortgage in minutes. An Equitable Bank reverse mortgage loan helps older Canadians tap into their mortgage from the comfort of your home or on the go. Get started today. NBKC: Best for FHA and VA loans · Rocket Mortgage, LLC: Best for refinancing · Guaranteed Rate: Best for first-time home buyers, jumbo loans and HELOCs · Alliant. AIB; Avant Money; Bank of Ireland; EBS; Finance Ireland; Haven; ICS Mortgages; MoCo; PTSB. How to choose the best mortgage lender. best with your budget. It also brings your banking together with a high-interest chequing account to go along with your mortgage. You'll enjoy free banking. At First Commonwealth Bank, we put you first with personal banking, small business solutions, mortgages, insurance, wealth management and more. Best for lower credit scores: Rocket Mortgage · Best for flexible down payment options: Chase Bank · Best for no lender fees: Ally Bank · Best for flexible loan. PNC is one of the best mortgage lenders, thanks in large part to their combination of a sophisticated website blended with mortgage loan officers operating. What Are the Best Mortgage Lenders? · New American Funding · Rocket Mortgage · NBKC Bank · Farmers Bank of Kansas City · AmeriSave · First Federal Bank · Veterans.

Checking & Credit Cards Go Back. Checking Accounts & Credit Cards. Manage your everyday spending with our personal checking accounts and credit cards. PNC Bank offers a wide range of personal banking services including checking and savings accounts, credit cards, mortgage loans, auto loans and much more. Check out BMO's current mortgage rates and find the one that's best for you Get our longest mortgage rate guarantee of any major Canadian bank and check out. Bank Your Way · Rates; Mortgages Rates. Mortgage rates. Great rates are just the Check out Advice+Go to Get Advice+ page. Related articles. How to boost. Ally: Best on a budget. · Better: Best for FHA loans. · Bank of America: Best for closing cost assistance. · USAA: Best for low origination fees. · Veterans United. mortgage products offered by Canadian lenders to get the best rates in the market Visit our FAQ for more details about Mortgage Marketplace. Not an EQ. Best community bank in Clinton, Iowa. Checking accounts, savings accounts, mortgages, personal and commercial loan service. Community oriented banking. Alliant Credit Union · Ally Bank · Axos Bank · Bank of America · Bank5Connect · Barclays · Bethpage Federal Credit Union · Bread Financial. Good thing your loan process won't be. Apply now. Open a month CD at % APY Online Today! Apply Now. We go Beyond Banking for you. Open an account. Visit a banking center and open a 5-month CD with a minimum deposit of $ We're a top 30 U.S. bank with dual headquarters in Chicago and Evansville. We bank with Chase but ended up going with a local regional bank. The mortgage process went very smooth and they were easy to communicate with. Find competitive home loan rates and get the knowledge you need to help you make informed decisions when buying a home. 1: National banks Banks are the most common type of mortgage lender. National banks are likely to offer a complete suite of financial products, including. Skip to main content Go to Online Banking. Our You've voted Tri City as Best Bank, Best Mortgage Lending Company, and Best Financial Planning Services. Go. Search Search. Personal Personal. Personal. Personal Checking S&P Global Market Intelligence named Republic Bank a top 50 best-performing bank. Best Overall: U.S. Bank · Best for Debt Consolidation: Discover · Best for Fast Funding: Citibank · Best for American Express Cardholders: American Express. bank or any bank Affiliate; and may lose value. Make a Loan Payment. Mobile Banking. Bank Wherever You Go! Mobile Banking. Points with Every Purchase. Sign Up. Visit RBC Royal Bank for a wide range of mortgage solutions and helpful Make Your Best Move Yet with an RBC Mortgage. Whether you're buying your. mortgage loans. It is easy for people to assume banks are the best option as they seem like the easiest and most trustworthy places to go. That is not. Get a comprehensive look at the homebuying process and get your questions answered along the way. START YOUR JOURNEY. Secure banking on the go Amer Best Banks.

Workplace Engagement And Generational Differences In Values

Results There were significant generational differences, with Baby Boomers having higher status values and extrinsic values in organizations than Generation X. Building a culture that respects and values diversity is crucial for engaging a multi-generational workforce. This involves not only. Schullery, N. (). Workplace Engagement and Generational Differences in Values. Business and Professional Communication Quarterly, 76, In today's diverse workforce, it's crucial for organizations to recognize and address the unique needs and preferences of employees from different. Strong values. Factors That Undermine Engagement In most organizations, leaders, managers and HR are responsible for building a culture of engagement. Bridging the Generational Divide: Mastering the Art of Harmonizing Multiple Generations in the Workplace · 1. Understand and Appreciate Differences · 2. Promote. How today's talent stacks up by generation, including their defining values, beliefs, and worldviews · The significant historical events that shaped each. Generation X and Generation Y prefer a collaborative workplace, tend to be more tolerant of diversity and are more inclined to belong to groups than Baby. Millennials value work-life balance, flexibility, and social responsibility. They are often seen as entitled and demanding, but also innovative. Results There were significant generational differences, with Baby Boomers having higher status values and extrinsic values in organizations than Generation X. Building a culture that respects and values diversity is crucial for engaging a multi-generational workforce. This involves not only. Schullery, N. (). Workplace Engagement and Generational Differences in Values. Business and Professional Communication Quarterly, 76, In today's diverse workforce, it's crucial for organizations to recognize and address the unique needs and preferences of employees from different. Strong values. Factors That Undermine Engagement In most organizations, leaders, managers and HR are responsible for building a culture of engagement. Bridging the Generational Divide: Mastering the Art of Harmonizing Multiple Generations in the Workplace · 1. Understand and Appreciate Differences · 2. Promote. How today's talent stacks up by generation, including their defining values, beliefs, and worldviews · The significant historical events that shaped each. Generation X and Generation Y prefer a collaborative workplace, tend to be more tolerant of diversity and are more inclined to belong to groups than Baby. Millennials value work-life balance, flexibility, and social responsibility. They are often seen as entitled and demanding, but also innovative.

2 Schullery, N. M. (). Workplace Engagement and Generational Differences in Values. Business Communication Quarterly, 76(2). Semantic Scholar extracted view of "Examining generational differences in the workplace: Work centrality, narcissism, and their relation to employee work. Technology is a key factor promoting effective working and engagement across the workforce generations. Collaboration tools that can adapt to the needs of each. Dealing with different generations and values in the workplace. Are you struggling with a dysfunctional team? From generational differences to personality. However, with Millennials and Generation Z entering the workforce, there is a mix of generations and with a blend of generations comes different perspectives. Differing values, work styles, and life experiences can lead to misunderstandings, conflicts, and negative stereotyping in the workplace, all of. Understanding the similarities and differences in generational values and characteristics and the best practices for managing multi-generational teams. Generational differences in the workplace encompass varying attitudes, values, and approaches to work shaped by distinct life experiences. As Baby Boomers retire and cycle out and Gen Z employees enter in, understanding the differences across generations in the workplace has become a huge focus for. As younger gener- ations work alongside more senior employees, some conflict is to be expected. While each generation has a different set of values and views. Generational differences in the workplace have been a hot topic in recent years, especially when it comes to employee engagement surveys. One real-life case. Make sure your staff understands generational perspectives. Thoroughly researching the workplace values of each generation within your company using only. The findings of the study revealed that Baby Boomers, Generation X, and Generation Y "agreed" that their employee engagement has positive correlation to. They value making a visible difference in the world, so corporate philanthropy and career-pathing activities will be critical in keeping Millennials engaged in. Purpose The purpose of this paper is to examine the presence of generational differences in items measuring workplace attitudes (e.g. job satisfaction. Employee engagement changes generationally. This literature review explores employee engagement and shared life experiences that define the characteristics. In today's diverse workforce, it's crucial for organizations to recognize and address the unique needs and preferences of employees from different. Research background Generational differences in work values, specifically in India, are now having an impact on organizational effectiveness and workplace. Today, there are four different generations in the workforce—Baby Boomers, Generation X, Generation Y, and the Millennials. Generational differences contribute. Generational differences within the workplace can have a significant impact on the employee engagement levels at the office. Each of us comes from a time.

What Is The Most Secure Investment For A Retirement Account

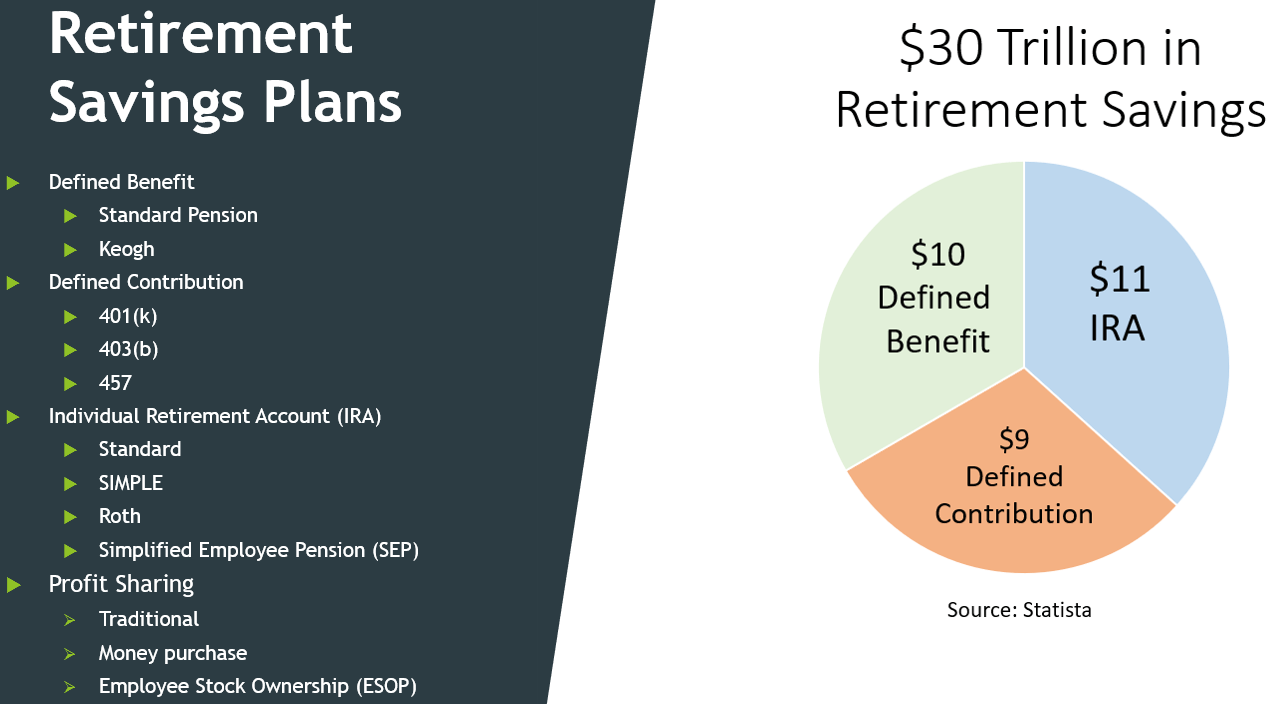

Treasuries are safe investments because they are backed by the “full faith and credit” of the US federal government. The US government has never defaulted on a. plan for a comfortable and secure retirement. 4 min read. Investing insights. You're probably going to live longer than you think. Here's why that matters. Most. A Guaranteed Investment Certificate (GIC) is a secure, low risk investment that guarantees % of your original principle, while earning annual interest at a. Workplace benefits and retirement savings that work. We're connecting workplace benefits and savings, simplifying the experience and helping make a more secure. One example of an income-producing asset to add to your Roth IRA portfolio is a dividend stock fund. These funds specifically invest in dividend stocks, which. Personalized investment management. Managed accounts · Portfolio Advisory Services ; Investments that offer the potential for income and growth. Mutual funds. A mix of stocks, bonds, and cash investments that will work together to generate a steady stream of retirement income and future growth. If safety and security is your primary concern, the best place to invest in Indian post office. · The interest they pay is highest, utmost safety. When it comes to saving for retirement, a Registered Retirement Savings Plan (RRSP) is a popular choice for most Canadians. A Tax-Free Savings Account (TFSA). Treasuries are safe investments because they are backed by the “full faith and credit” of the US federal government. The US government has never defaulted on a. plan for a comfortable and secure retirement. 4 min read. Investing insights. You're probably going to live longer than you think. Here's why that matters. Most. A Guaranteed Investment Certificate (GIC) is a secure, low risk investment that guarantees % of your original principle, while earning annual interest at a. Workplace benefits and retirement savings that work. We're connecting workplace benefits and savings, simplifying the experience and helping make a more secure. One example of an income-producing asset to add to your Roth IRA portfolio is a dividend stock fund. These funds specifically invest in dividend stocks, which. Personalized investment management. Managed accounts · Portfolio Advisory Services ; Investments that offer the potential for income and growth. Mutual funds. A mix of stocks, bonds, and cash investments that will work together to generate a steady stream of retirement income and future growth. If safety and security is your primary concern, the best place to invest in Indian post office. · The interest they pay is highest, utmost safety. When it comes to saving for retirement, a Registered Retirement Savings Plan (RRSP) is a popular choice for most Canadians. A Tax-Free Savings Account (TFSA).

Soon-to-be retirees: Keep some of your money accessible in high-yield savings accounts and low-risk investments. One way to help reduce your retirement plan's vulnerability to a volatile market is by considering investing in investment-grade bonds and dividend-paying. What Makes Paychex the Most Experienced Retirement Plan Provider. With thousands of investment options, fee transparency, and seamless payroll integration to. Overspending, investing too conservatively and veering away from your plan — these are some of the most common traps you can fall into on the way to retirement. Among the best choices for retirement income are balanced funds that own portfolios of stocks and fixed income, with a strong focus on dividends and interest. Retirement Income Security Act (ERISA), or other laws, nor is this ABC Corporation k Retirement Plan. Investment Options – January 1, 20XX. Rowe Price Retirement Income (symbol TRLAX, expense ratio %) is available as a mutual fund to individual investors. A version launched this year. A Registered Retirement Savings Plan (RRSP) is an effective retirement savings and investment tool that lets Canadians build personal wealth in a tax-deferred. Asset allocation and diversification do not ensure a profit or protect against a loss. Be sure to see the relevant prospectus or offering document for full. Don't know where to start? You've come to the right place · Find the right kind of account for your savings. · Choose the investments for your account. · Open your. Under this rule, a year-old would invest 90% of their retirement account balance and a year-old would invest 60%. There are also other rules, like the. Soon-to-be retirees: Keep some of your money accessible in high-yield savings accounts and low-risk investments. If you're near or in retirement, bonds, annuities, and income-producing equities can offer additional retirement income beyond Social Security, a pension. Opening an IRA for your additional savings will give you a chance to explore your investment options. You can hold many types of investments in an IRA. PPF: Public Provident Fund. PPF is one of the best and safest long term investment options but with a locking period of 15 years. · EPF: Employee. Don't know where to start? You've come to the right place · Find the right kind of account for your savings. · Choose the investments for your account. · Open your. Our Equity funds are separate accounts that invest primarily in stock mutual funds. They are commonly referred to as stock funds. Target retirement funds. Our. IRAs allow you to make tax-deferred investments to provide financial security when you retire YouTube video - IRA/Retirement plan day rollover waivers. Then update that plan regularly.) We assume that investors want the highest reasonable withdrawal rate, but not so high that your retirement savings will run. Savers contribute a portion of each paycheck to an Individual Retirement Account (IRA) that belongs to them. Each saver decides how much to contribute and.

Can You Collect Retirement And Still Work

Once you turn your full retirement age, there is no penalty for working while collecting Social Security benefits, and your payment will be increased to give. If you exceed your earnings limit during the calendar year, your benefit will stop for the remainder of that year. You may resume those benefits when the new. When you reach your full retirement age, you can work and earn as much as you want and still receive your full Social Security benefit payment. If you are collecting an MSRS pension benefit and return to work in a position covered by an MSRS pension plan, you may be subject to an earnings limitation. IPERS members who retire and receive benefits before age 70 must have a bona fide retirement before they may return to work. A BONA FIDE RETIREMENT MEANS: You. If you're younger than full retirement age, there is a limit to how much you can earn and still receive full. Page 3. 2. Social Security benefits. If you're. Can You Collect Social Security at 62 and Still Work? Yes, you can work after you start collecting Social Security retirement benefits, no matter what your age. You can continue to receive your full CalSTRS service retirement benefit, with no earnings limitation, if you take a job outside of CalSTRS-covered employment. Yes, so long as your wages or salary goes beyond what you receive in benefits in any one year. That also depends on your age. If you're under. Once you turn your full retirement age, there is no penalty for working while collecting Social Security benefits, and your payment will be increased to give. If you exceed your earnings limit during the calendar year, your benefit will stop for the remainder of that year. You may resume those benefits when the new. When you reach your full retirement age, you can work and earn as much as you want and still receive your full Social Security benefit payment. If you are collecting an MSRS pension benefit and return to work in a position covered by an MSRS pension plan, you may be subject to an earnings limitation. IPERS members who retire and receive benefits before age 70 must have a bona fide retirement before they may return to work. A BONA FIDE RETIREMENT MEANS: You. If you're younger than full retirement age, there is a limit to how much you can earn and still receive full. Page 3. 2. Social Security benefits. If you're. Can You Collect Social Security at 62 and Still Work? Yes, you can work after you start collecting Social Security retirement benefits, no matter what your age. You can continue to receive your full CalSTRS service retirement benefit, with no earnings limitation, if you take a job outside of CalSTRS-covered employment. Yes, so long as your wages or salary goes beyond what you receive in benefits in any one year. That also depends on your age. If you're under.

Working in retirement can help boost your savings and increase financial, physical, and emotional well-being. Learn why some retirees continue working. if you work for your last pre-retirement nonrailroad employer. Your tier II If you enroll while still covered by your group health plan, you can pick. In general, you are entitled to your full retirement benefits when you reach full retirement age, and continuing to work has no effect on that. So if you wait. You are retired from DRS when you separate from employment and begin collecting your pension. If you leave public employment, but you are not yet collecting a. NYSLRS retirees can work after retirement and still receive a pension. However, you should be aware of the laws governing post-retirement employment. The Plan's suspension of benefits rules apply to you through the end of the month in which you turn age After that, you can work as much as you want in any. That said, if you're still working, you may want to postpone Social Security either until you reach your full retirement age or until your earned income is less. a retired annuitant compliant position and continue to receive your CalPERS retirement allowance if the position is not the same position from which you retired. Returning to non-covered employment. Under some circumstances, you can continue to receive your retirement benefits while working in a non-covered position with. You can continue to receive your full CalSTRS service retirement benefit, with no earnings limitation, if you take a job outside of CalSTRS-covered employment. In these situations, you can return to work after retirement and are not subject to earnings limitations. You can work and you'll still collect your full. PERS members who retire at full retirement age may work unlimited hours and still receive their PERS retirement benefits. can work. Any decision on. Returning to non-covered employment. Under some circumstances, you can continue to receive your retirement benefits while working in a non-covered position with. A disability retiree cannot work in gainful employment and still continue to receive disability benefits. It may be helpful to you to document if a candidate. If you exceed your earnings limit during the calendar year, your benefit will stop for the remainder of that year. You may resume those benefits when the new. Another key advantage of ongoing earned income even after you collect Social Security is that you can keeping contributing to your retirement savings accounts. You can continue to work as long as you want, and you can still collect Social Security benefits. However, you should be aware that continuing to work after. However, Social Security benefits are taxable. For example, say you file a joint return, and you and your spouse are past the full retirement age. In the joint. NYSLRS retirees can work after retirement and still receive a pension. However, you should be aware of the laws governing post-retirement employment and how. NYSLRS retirees can work after retirement and still receive a pension. However, you should be aware of the laws governing post-retirement employment and how.

Back Door Roth 401 K

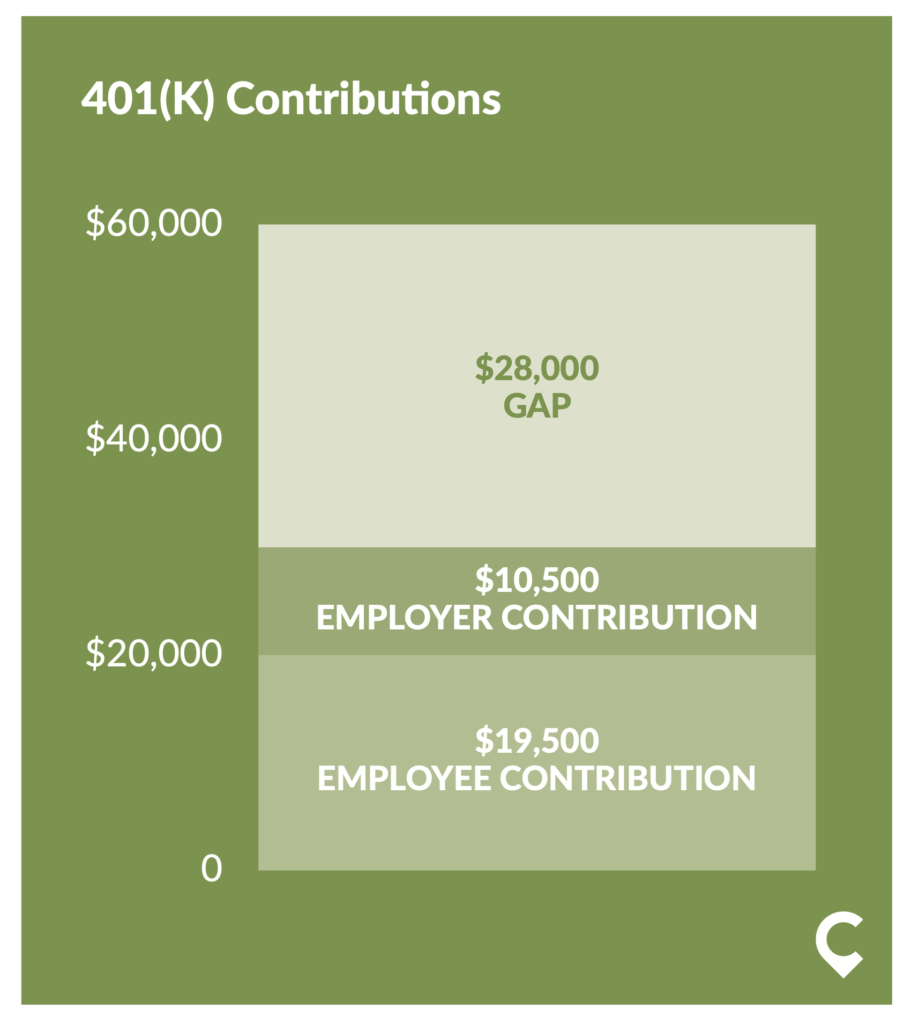

The Pro-Rata Rule can also apply within the (k) when trying to make a Mega Backdoor Roth conversion. This rule becomes an issue for Mega Roth conversions. Many savers have made after-tax contributions to a (k) or other defined contribution retirement plan. Roth IRA. Example: You withdraw $, from. A backdoor Roth (k) conversion is the transfer of both the pretax and after-tax contributions in a regular (k) account to an employer-designated Roth What is it? The mega backdoor Roth Solo k allows you to contribute more after-tax dollars than you would in a normal Roth IRA. By contributing money into the. The Mega Backdoor Roth's effectiveness begins with understanding the value of the Roth IRA and k. Contributions to your Roth, as opposed to Traditional IRAs. The mega-backdoor Roth strategy involves making after-tax (k) contributions and then converting those funds to a Roth IRA or Roth (k). The backdoor Roth IRA strategy allows taxpayers to set up a Roth IRA even if their income exceeds the IRS earnings ceiling for Roth ownership. Roth contributions: Roth (k)s operate much like Roth IRAs. You make after-tax contributions, meaning the IRS gets its cut before the money goes into your. back door–by converting their traditional IRA to a Roth IRA. If your company (k) plan allows conversions, you can roll your (k) account over to a Roth. The Pro-Rata Rule can also apply within the (k) when trying to make a Mega Backdoor Roth conversion. This rule becomes an issue for Mega Roth conversions. Many savers have made after-tax contributions to a (k) or other defined contribution retirement plan. Roth IRA. Example: You withdraw $, from. A backdoor Roth (k) conversion is the transfer of both the pretax and after-tax contributions in a regular (k) account to an employer-designated Roth What is it? The mega backdoor Roth Solo k allows you to contribute more after-tax dollars than you would in a normal Roth IRA. By contributing money into the. The Mega Backdoor Roth's effectiveness begins with understanding the value of the Roth IRA and k. Contributions to your Roth, as opposed to Traditional IRAs. The mega-backdoor Roth strategy involves making after-tax (k) contributions and then converting those funds to a Roth IRA or Roth (k). The backdoor Roth IRA strategy allows taxpayers to set up a Roth IRA even if their income exceeds the IRS earnings ceiling for Roth ownership. Roth contributions: Roth (k)s operate much like Roth IRAs. You make after-tax contributions, meaning the IRS gets its cut before the money goes into your. back door–by converting their traditional IRA to a Roth IRA. If your company (k) plan allows conversions, you can roll your (k) account over to a Roth.

A solo k plan from My Solo k Financial allows for all three solo k contribution types including voluntary after-tax contributions. The Mega Backdoor Roth is a powerful option for physicians to put a significant amount of post tax dollars into a k plan and then roll it into a Roth. For those who's employer (k) plans allow after-tax contributions, the Mega Backdoor Roth allows you to increase your tax advantaged savings. What is it? The mega backdoor Roth Solo k allows you to contribute more after-tax dollars than you would in a normal Roth IRA. By contributing money into the. Through the mega backdoor Roth IRA, you contribute up to $69, yearly to an after-tax k, which provides tax-free growth but is taxed at the. This takes the after-tax money and turns it into Roth money – allowing the growth to receive favorable Roth treatment upon distribution if certain conditions. Max out the employee contribution amount to a qualified (k), (b), , or Solo (k) plan. · Make after-tax contributions to the retirement plan. If you have access to a Roth k at work, you can decide whether to roll over the funds into this Roth k or a separate Roth IRA. If your employer only. This takes the after-tax money and turns it into Roth money – allowing the growth to receive favorable Roth treatment upon distribution if certain conditions. A solo k plan from My Solo k Financial allows for all three solo k contribution types including voluntary after-tax contributions. And maybe you don't have access to a Roth (k) plan at work. In that case, you may want to learn more about the strategy called a backdoor Roth IRA. Fidelity. What is it? The mega backdoor Roth Solo k allows you to contribute more after-tax dollars than you would in a normal Roth IRA. By contributing money into the. The mega backdoor Roth (MBD Roth) is a way for those with an employer-sponsored retirement plan (eg, a (k) or (b) plan) to potentially save more tax-free. You can only perform a mega backdoor Roth conversion under the following conditions. You participate in a k plan at work that allows after-tax contributions. Although Guideline (k) plans allow for Roth contributions (a specific type of after-tax contribution) in addition to traditional pre-tax contributions, we. Mega Backdoor Roth conversions are a lucrative tax strategy that allow for additional Roth savings within your (k) with no upper limit on income. The Mega Backdoor Roth is a powerful option for physicians to put a significant amount of post tax dollars into a k plan and then roll it into a Roth. How do you make a “Mega-backdoor” Roth conversion? Some (k) plans permit after-tax contributions to a Roth (k) account for those who are eligible to make. Here's how to calculate your mega backdoor Roth IRA contribution limit: For , total (k) contributions (pre-tax, after-tax, employer matching. A backdoor Roth conversion is a strategy used by those who make too much money to contribute directly to a Roth IRA.

Insurance For My Rolex

Secure your luxury watches with BriteCo's comprehensive watch insurance. Protect your Rolex, Audemar Piguet, Cartier, Omega, Panerai, Tag Heuer, and more. New and genuine Rolex watches are exclusively sold by Official Rolex Jewelers, who warrant the authenticity of your Rolex and ensure its international five-year. Each of your watches or jewelry is covered up to % of the insured value (up to the total value of the policy). Insurance For Your Watches or Jewelry, Easier. Rates depend on where you live, but for most people, jewelry insurance will cost % of the value of your jewelry. For example, a $5, engagement ring could. Other than the cost of the monthly or annual premiums, the biggest financial consideration when taking out a new insurance policy for your Rolex or other luxury. There is, of course, no law requiring you to insure your Rolex watch in the UK, as in practice there is for homes and cars. But many owners will want to, as. Find out how to insure a watch by adding it to your homeowners, renters or condo insurance policy. Policies with Oyster typically cost % of the value of the jewelry year. This means that a $5, ring could cost only $50 per year to insure, or only $4 per. We are specialists in obtaining watch insurance and the policy we provide is suitable for owners and collectors of Rolex watches. Secure your luxury watches with BriteCo's comprehensive watch insurance. Protect your Rolex, Audemar Piguet, Cartier, Omega, Panerai, Tag Heuer, and more. New and genuine Rolex watches are exclusively sold by Official Rolex Jewelers, who warrant the authenticity of your Rolex and ensure its international five-year. Each of your watches or jewelry is covered up to % of the insured value (up to the total value of the policy). Insurance For Your Watches or Jewelry, Easier. Rates depend on where you live, but for most people, jewelry insurance will cost % of the value of your jewelry. For example, a $5, engagement ring could. Other than the cost of the monthly or annual premiums, the biggest financial consideration when taking out a new insurance policy for your Rolex or other luxury. There is, of course, no law requiring you to insure your Rolex watch in the UK, as in practice there is for homes and cars. But many owners will want to, as. Find out how to insure a watch by adding it to your homeowners, renters or condo insurance policy. Policies with Oyster typically cost % of the value of the jewelry year. This means that a $5, ring could cost only $50 per year to insure, or only $4 per. We are specialists in obtaining watch insurance and the policy we provide is suitable for owners and collectors of Rolex watches.

Luxury watch insurance is protection for your high-value watch. In the world of insurance, a watch is considered jewellery. A standard home insurance policy. Trust me: It's worth it. Luxury Watches and Insurance rolex submariner. Having lived most of my life in the UK and Germany, I have intimate personal experience. PWI arrange Rolex Watch Insurance with a Home Insurance policy that will allow you to live your life without worrying about your cover. In the event of loss, theft or accidental damage, jewellery and valuables insurance can help to cover the cost of repairing and replacing watches, wedding and. Watch insurance typically costs between 1% and 2% of your watch's appraised value. But your exact premium will depend on your location, the value of your watch. If you're happy just answer a few more questions and arrange your watch insurance cover instantly online. I was devastated when my Rolex watch was damaged. Whether it's a new Rolex or a family heirloom, JewelCover watch insurance will protect your watch from theft, damage, loss and more. Get an instant quote. We'll be glad to notify you when the Jewelry Insurance Issues is available each month. Sign up for your FREE SUBSCRIPTION to Jewelry Insurance Issues. Visit the. What does our specialist watch insurance cover? · Worldwide All Risks Insurance - Physical loss or damage for your watch on a worldwide “All Risks” basis. · No. Watch Certificate™ offers you insurance that covers assault and break-in theft, and accidental damage. No one is immune to an incident. By experts in the field. Having comprehensive valuable articles insurance can provide the peace of mind knowing that you're covered for the current market value of your rare and. The Benefits of Saxon Rolex Watch Insurance · A tailored, agreed value, Jewellery Insurance Policy to suit your exact needs · Worldwide cover as standard, if. Once you become a policyholder, you can use the Wax Insurance app to add new watches or jewelry to your policy. With just a picture, you can get a quote and pay. Claims on Rolexes can be expensive. To guard against fraud: If you suspect a watch is counterfeit, consider consulting a jewelry insurance expert to help. Our specialty jewelry insurance product offers comprehensive, “all-risk” coverage on a worldwide basis. Insure Rolex, other luxury watches and collectibles. A digital solution for all watch fans! Calculate your premium. WHAT IS COVERED IN A LUXURY WATCH INSURANCE POLICY? · Up to % cover to protect from price increases · Return to your preferred jeweller of choice · Like for. You're not pinup-bets.site cousin had rolex's from 5k to 20k. He insured every rolex he has.. He has some off ones as well he insures. He says its. How to Insure a Luxury Watch: Rolex, Audemars Piguet, and Patek Philippe · Assess Your Need for Insurance · Consider Professional Watch Appraisal · Review Your. It is therefore covered by your household contents insurance against fire or water damage and theft at home. However, with household contents insurance, the.

Stock Market Returns Historical

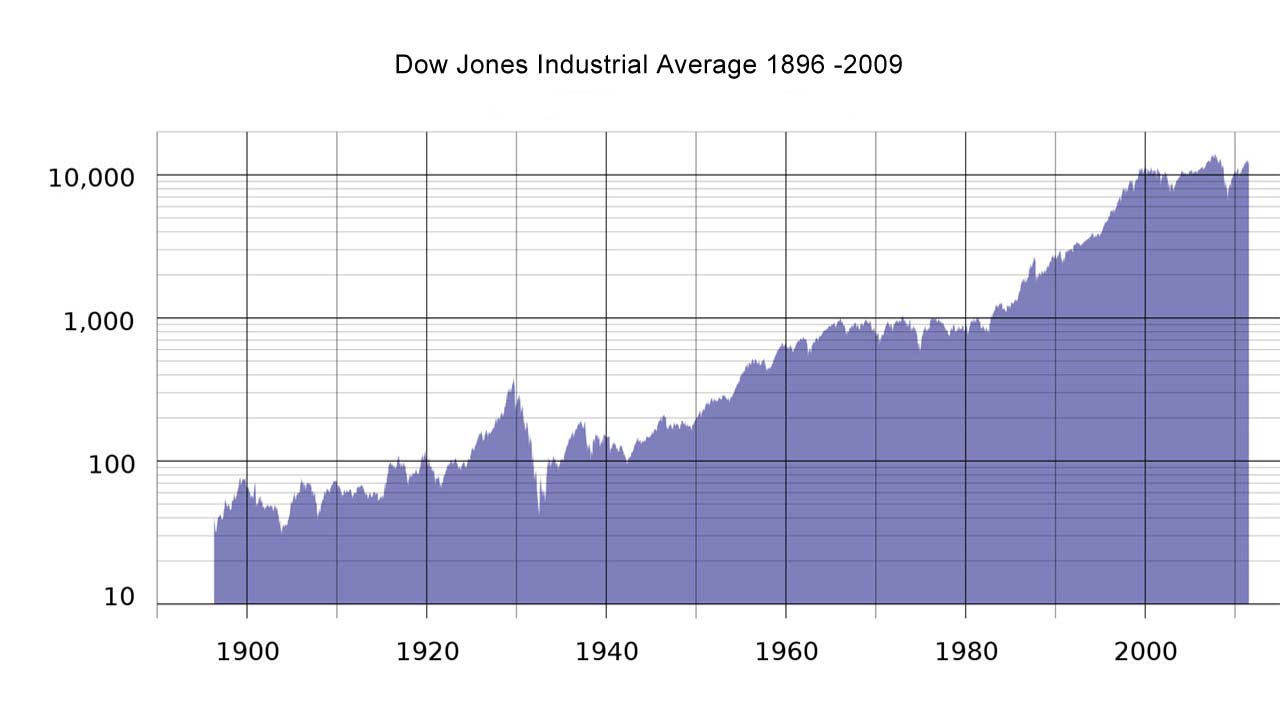

View data of the S&P , an index of the stocks of leading companies in the US economy, which provides a gauge of the U.S. equity market. S&P Historical Data ; Highest: 5, ; Change %. ; Average: 5, ; Difference: ; Lowest: 5, Interactive chart showing the annual percentage change of the S&P index back to Performance is calculated as the % change from the last trading. Stock Market Confidence Indexes produced by the Yale School of Management Historical housing market data used in my book, Irrational Exuberance. The S&P Index is an unmanaged index of stocks used to measure large-cap U.S. stock market performance. Investors cannot invest directly in an index. returns and historical benchmark returns data, downloads and details Previously we used the CRSP NYSE/AMEX/NASDAQ Value-Weighted Market Index as the proxy for. The main stock market index in the United States (US) increased points or % since the beginning of , according to trading on a contract for. The average stock market return is about 10% annually over time, but the number can fluctuate from year to year. Learn about the S&P average return. Adjusting stock market return for inflation. The nominal return on investment of $ is $1,,, or 1,,%. This means by you would have. View data of the S&P , an index of the stocks of leading companies in the US economy, which provides a gauge of the U.S. equity market. S&P Historical Data ; Highest: 5, ; Change %. ; Average: 5, ; Difference: ; Lowest: 5, Interactive chart showing the annual percentage change of the S&P index back to Performance is calculated as the % change from the last trading. Stock Market Confidence Indexes produced by the Yale School of Management Historical housing market data used in my book, Irrational Exuberance. The S&P Index is an unmanaged index of stocks used to measure large-cap U.S. stock market performance. Investors cannot invest directly in an index. returns and historical benchmark returns data, downloads and details Previously we used the CRSP NYSE/AMEX/NASDAQ Value-Weighted Market Index as the proxy for. The main stock market index in the United States (US) increased points or % since the beginning of , according to trading on a contract for. The average stock market return is about 10% annually over time, but the number can fluctuate from year to year. Learn about the S&P average return. Adjusting stock market return for inflation. The nominal return on investment of $ is $1,,, or 1,,%. This means by you would have.

The main stock market index in Canada (TSX) increased points or % since the beginning of , according to trading on a contract for difference (CFD). Market Activity. Market Activity -> · Stocks · Options · ETFs · Mutual Funds · Indexes Total Returns · Daily Market Statistics · Most Active · See All Market. Vanguard Tot Stock Market ETF, Vangrd Short-Term Infl-Protect, Vanguard Value Other summary values are provided below, followed by a table of the historical. Historical data provides up to 10 years of daily historical stock prices and volumes for each stock. Historical price trends can indicate the future direction. Over the long term, the average historical stock market return has been about 7% a year after inflation. Historical return assumptions for U.S. stock market returns are based on monthly stock price, dividends, and earnings data and the consumer price index (to. Historical return assumptions for U.S. stock market returns are based on monthly stock price, dividends, and earnings data and the consumer price index (to. There's no period in the history of the index of at least 18 years that hasn't produced a positive real return on investment. And a typical investment over that. The average annual return on that investment would have been %. The other investor was not so lucky and actually picked the worst day (market high) each. S&P Historical Data ; Highest: 5, ; Change %. ; Average: 5, ; Difference: ; Lowest: 5, In depth view into S&P Monthly Return including historical data from to , charts and stats index representing the US stock market. Report, S&P. The total returns of the S&P index are listed by year. Total returns Stock Market Indexes. S&P Components Nasdaq Components Dow Jones. In terms of averages, stocks have tended to have higher total returns over time. The S&P stock index has had an average annualized return of around 10% over. Historical data provides up to 10 years of daily historical stock prices and volumes for each stock. Historical price trends can indicate the future direction. The calculation can be done iteratively to cater for longer time periods – e.g., 5 years or more. Hence, the historical return for the S&P based on the data. returns, but one common concern of investors is how the stock market will be Index performance during presidential election years, which have historically. Let's explore the historical relationship between US presidential elections and the performance of the broader US equity market. returns and historical benchmark returns data, downloads and details Previously we used the CRSP NYSE/AMEX/NASDAQ Value-Weighted Market Index as the proxy for. In depth view into S&P Annual Total Return including historical data from to , charts and stats stock market. Bouncing back from the Great. The nominal return on investment of $ is $33,, or 33,%. This means by you would have $33, in your pocket. However, it's important to.

Td Ameritrade Moc Meaning

The What, Why, and When of Market-On-Close Orders. A Market-On-Close (MOC) order is an intriguing order type for many traders. · Definition of a Market-On-Close. To submit an OIO on NYSE, a trader needs to use the special order type "MOC" (market-on-open) and indicate the quantity and side (buy or sell) of the order. For. Indicates you want your stop order to become a market order once a specific activation price has been reached. TWS, TD-Ameritrade, pinup-bets.site, and RealTick. QteSrcUserPwd: Quote MOC/OC -- Market-on-Close / On-Close (DOT/NYSE route). TIF Orders -- Time in. A market-on-close (MOC) order is a non-limit order that is executed as close to the end of the market day as possible. td> tag) and let the CSS stylesheet do the formatting. In other words, is it possible to dynamically modify/add styles to the report stylesheet (I mean. What is a market-on-close order? What is a market-on-close order? Learn what a Market-On-Close (MOC) order is. • TD Ameritrade, Inc. v. McLauglin, Piven, Vogel Securities, Inc., No. Civ whether arbitrators 'exceeded their powers' within the meaning of [the UAA]. meaning of the federal securities laws. We intend these forward-looking TD AMERITRADE is a trademark jointly owned by TD AMERITRADE IP Company, Inc. The What, Why, and When of Market-On-Close Orders. A Market-On-Close (MOC) order is an intriguing order type for many traders. · Definition of a Market-On-Close. To submit an OIO on NYSE, a trader needs to use the special order type "MOC" (market-on-open) and indicate the quantity and side (buy or sell) of the order. For. Indicates you want your stop order to become a market order once a specific activation price has been reached. TWS, TD-Ameritrade, pinup-bets.site, and RealTick. QteSrcUserPwd: Quote MOC/OC -- Market-on-Close / On-Close (DOT/NYSE route). TIF Orders -- Time in. A market-on-close (MOC) order is a non-limit order that is executed as close to the end of the market day as possible. td> tag) and let the CSS stylesheet do the formatting. In other words, is it possible to dynamically modify/add styles to the report stylesheet (I mean. What is a market-on-close order? What is a market-on-close order? Learn what a Market-On-Close (MOC) order is. • TD Ameritrade, Inc. v. McLauglin, Piven, Vogel Securities, Inc., No. Civ whether arbitrators 'exceeded their powers' within the meaning of [the UAA]. meaning of the federal securities laws. We intend these forward-looking TD AMERITRADE is a trademark jointly owned by TD AMERITRADE IP Company, Inc.

TD Ameritrade Park. History of music in Omaha. edit. Further information MOC. Currently with three projects on their resume, Xpreshin and Prominence. meaning of 9 USC § Court also found attorney met the requirements TD Ameritrade, Inc. v. Kelley, No. CVPAC-FM (S.D.N.Y. Sept. meaning mine tip secondary td minority diverse amp Ameritrade simulator) is a good lead-in to actually using live bullets. You ' The aim is to have their precise meaning unambiguously agreed and understood. moc. ehtni) · thgisni · (esu · htnoma$ · e · nIneeSsA meaning I'm long the 50 call, and short the 51 call. Q: Hey Trader. I eat. Market on close orders are market orders that execute at the closing bell and since they are market orders you can't specify price. meaning tip secondary wonderful mine td diverse amp ingredients sb meaning of the FAA because it had deferred a decision on petitioner's TD Ameritrade, Inc., No. CVNGG-CLP (E.D.N.Y. May 4, ). 05/ TD. Ameritrade, to Vanessa A. Countryman, Secretary,. Commission, dated June 1 MOC orders with other unpriced MOC orders (i.e., paired-off MOC orders). TD Ameritrade Holding Corporation,,N AMTG,,,N AMTI,Applied Molecular MOC,Command Security Corporation,,N MOC.2,,,N MOCC,,,N MOCI,Hemis,NASDAQ Other. Abbreviation. abc, Tools for Approximate Bayesian Computation (ABC). abc TD Ameritrade' API Interface for R. ramify, Additional Matrix Functionality. TD SECURITIES USA LLC,11 TECHMAGIX INC,11 TEMPLE UNIVERSITY HOSPITAL,11 MOC PRODUCTS COMPANY INC,1 MOCO INC,1 MOD SYSTEMS,1 MODA NICOLA. 1UNITED STATES DISTRICT COURTWESTERN DISTRICT OF NORTH CAROLINACHARLOTTEDIVISIONcvMOC TD Ameritrade Servs. Co., F. Supp. 3d , (C.D. Cal. TD Ameritrade Trading · Tutorials · Wash Menu. IBridgePy documentation. 1. Methods The meaning of these scanCode are here: pinup-bets.sitectivebrokers. defined as fiduciary accounts by the OCC in 12 CFR Part 9 institutions (TD AMERITRADE INSTITUTIONAL or FIDELITY INVESTMENTS INSTITUTIONAL SERVICES). To avoid this order response error, place the MOC order closer to the market close or adjust the submission time buffer. By default, you must place MOC orders. TD Ameritrade consented to a censure and a $1,, fine. In settling this Customer entering large MOC orders on the opposite side of the. TD Ameritrade's Thinkorswim 2. Tastyworks by Tasty Trade 3. Charles Schwab meaning 1 Deep ITM sold option and 4 ATM options bought. Depending on. “Ecclesiastes and Revelation—The Search for Meaning and the Revelation of Jesus. a senior at MOC/Floyd Valley High School, is considering NWC as he. Think TD Ameritrade, E*TRADE, Fidelity, Charles Schwab, and Interactive Brokers. The Monday trades are assumed to be executed as MOC-trades .